Flood Insurance: It Can Flood Anywhere It Rains When most people think about floods, they picture overflowing rivers, hurricanes, or […]

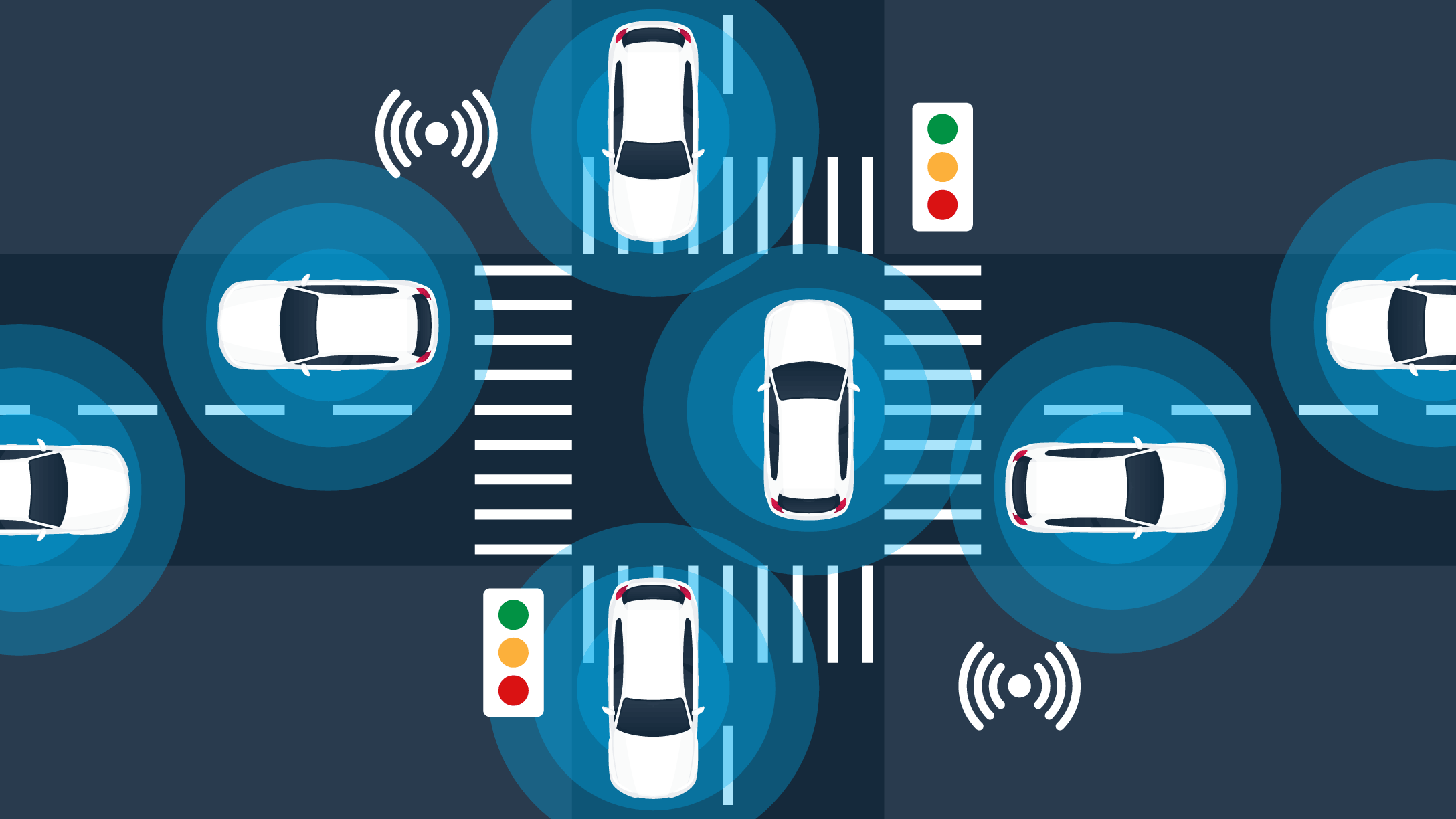

Smarter Driving – The Rise of Telematics in Auto Insurance

Telematics is revolutionizing the auto insurance industry by offering a personalized, data-driven approach to premiums and coverage. Here’s why drivers […]

How Roadside Assistance Can Help You Save on Your Auto Insurance

With the challenges of inflation and rising prices, it’s important to us to help our clients examine all avenues to […]

What is Uninsured Motorist Insurance?

Uninsured motorist and underinsured motorist are auto insurance coverages that protect you and your vehicle if you’re involved in a […]

Why Are Home and Auto Insurance Rates Rising in 2023?

Why home and auto insurance rates are rising in 2023 Due to an unusual convergence of market trends, ushered in […]

5 Ways to Reduce Your Homeowners Insurance Premium

Insurance is a necessary cost of owning a home. It covers damage to your house due to fires, hail damage […]

4 Reasons to Add Water Backup Coverage

If you asked homeowners to create a list of situations they hoped to never have to deal with at home, […]

How to Tell if You Need a New Roof

Many people don’t think about how much work their roof does to protect their home until an issue arises. A […]

Is Your Motorcycle Coverage the Right Fit?

Spring has arrived in our area and with it comes the return of motorcycles on the roadway. Not all bikes […]

6 Tips to Improve your Car’s Gas Mileage

In a time of fluctuating gas prices, it can be difficult to find savings at the pump. Did you know […]

8 Ways to Save on Auto Insurance

After embracing a break at the height of the pandemic, motorists in the U.S. are bracing for a rise in […]

Does Your Auto Insurance Cover a Rental Car?

You’re renting a vehicle because your car breaks down and you have places to be. Will your insurance cover your […]

Should Roommates Share Renters Insurance?

You can share utility bills with your roommate, but you should not share a renters insurance policy. Though some insurance […]

Does Your Insurance Policy Cover Your Valuables?

Homeowners or renters insurance will protect your belongings in your home and help you replace them should they be destroyed, […]

The Basics of Condo Insurance

A condominium is different from a house – you own a part of the building, but not all of it. […]

Top 10 Reasons to Talk to Your Insurance Agent

We are about to enter a season of change, as summer winds down and fall begins. Whether you’re getting married, […]

Why You Need an Umbrella Policy

A personal umbrella policy is a critical step in financial protection, helping ensure your assets – your car, house, investments, […]

Personal Liability Coverage

Personal liability insurance is about financial protection – for you and your family. Personal liability occurs in the event of […]

Why You Need to Create a Household Inventory

Imagine needing to list every possession in your home or apartment, along with each item’s worth – after your belongings […]

The Importance of Loss of Use

If you were forced to move out of your house or even a rental property, could you comfortably cover increased […]

How to Combine Insurance After Marriage

We’re in the height of wedding season, so it’s a good time to share my advice on marriage and car […]

Why Replacement Cost Matters

One of the many side effects of the COVID-19 pandemic has been the astronomical increase in the cost of building […]

3 Common Gaps In Your Auto Insurance

A gap in coverage on your auto policy can result in receiving a lower claim payout amount than you expected, […]

Six Surprising Things You Might Not Know About Homeowners Insurance

Water damage, fire, and theft are the primary situations that homeowners are usually concerned about, but home insurance may also […]

What is Gap Insurance?

Gap insurance is a type of car insurance coverage that pays for the “gap” between what a car is worth […]

Do You Need Renters Insurance?

Renters insurance covers your personal belongings and provides liability coverage when you’re living in an apartment, house or condo that […]

Insuring Your New Engagement Ring

Engagement season is upon us, and insuring your new ring should kickstart your wedding planning process. This is the moment […]

How A New Job Impacts Your Insurance

Getting a new job is a major life change. Your salary may change, your commute may change, but have you […]

How Much Homeowners Insurance Do I Need?

Purchasing a home is huge milestone for you and your family, and an exciting time! Having the right insurance will […]

Insuring Your Jewelry

Insurance is not just for your home and auto, but it’s important to be sure you have enough insurance for […]

More Renters May Become Home Owners Thanks to Telecommuting

While the COVID-19 pandemic has brought untold changes to the American public, some of the developments may have unforeseen benefits. […]

Could You Be Saving Money by Refinancing?

Refinancing is the process of replacing an existing mortgage with a new loan. Typically, people refinance their mortgage in order […]

What is a Condo Policy?

A Condo policy is very different from a traditional Homeowners policy. A typical Condo insurance policy includes several standard coverages […]

Should You Rent or Buy?

Here’s a list of pros and cons of renting a home from one of our top carriers, Nationwide Insurance. Careful […]

COVID-19 Car Insurance Rebates: Which Companies Are Refunding Money?

Stay-at-home orders due to coronavirus means people are driving less, and the drop has been significant. According to tracking group […]